|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

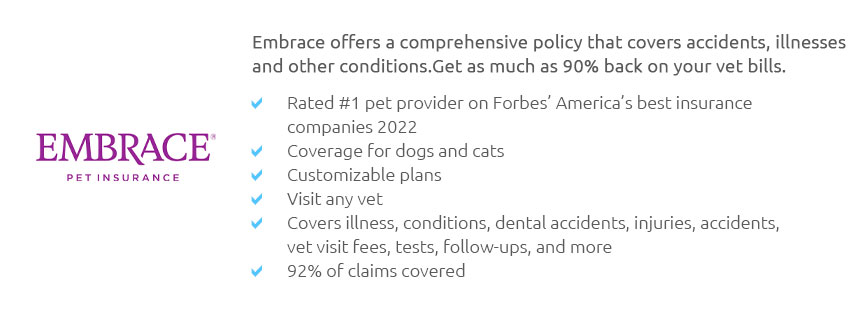

Understanding the Importance of Dog Insurance: A Comprehensive GuideIn recent years, the concept of dog insurance has gained considerable traction, making it a topic of keen interest among pet owners who are increasingly seeking ways to safeguard the health and well-being of their beloved canine companions. The rise in veterinary costs coupled with the growing awareness about pet healthcare has made insurance for dogs not just a luxury, but a necessity for many. This article delves into the intricacies of dog insurance, exploring its key features, benefits, and the peace of mind it offers to pet parents. At its core, dog insurance serves as a financial safety net, helping to mitigate the unforeseen expenses that can arise from a myriad of health issues or accidents that our furry friends might encounter. With a variety of plans available, ranging from basic accident coverage to comprehensive health plans that cover hereditary conditions, vaccinations, and even wellness visits, pet insurance offers a level of protection that allows owners to focus on the care and recovery of their pets without the added burden of financial strain. One of the standout features of dog insurance is its flexibility and adaptability to meet the diverse needs of different dog breeds and their unique health profiles. For instance, larger breeds like Great Danes or Saint Bernards might be predisposed to certain conditions such as hip dysplasia, while smaller breeds might face issues related to dental health. Insurance providers typically offer customizable plans that can be tailored to address these specific needs, ensuring that each dog receives the most suitable coverage. Moreover, the competitive nature of the insurance market has led to the emergence of various added benefits that come with dog insurance policies. Many insurers now offer services such as 24/7 access to veterinary helplines, coverage for alternative therapies like acupuncture and hydrotherapy, and even support for behavioral issues. Such comprehensive coverage not only enhances the quality of life for pets but also empowers owners to make informed decisions about their pet’s healthcare without hesitation. While the prospect of investing in dog insurance can initially seem daunting due to the perceived complexity and cost, it is crucial to weigh these factors against the long-term benefits and potential savings. A single unexpected visit to the vet can be costly, and having insurance can significantly reduce or even eliminate these expenses, allowing you to focus solely on your pet’s recovery. When considering dog insurance, it is vital to conduct thorough research and compare different providers to find a plan that best suits your pet’s needs and your financial situation. Look for plans that offer lifetime coverage, have a clear reimbursement process, and possess a good reputation for customer service. Reading reviews and seeking recommendations from fellow pet owners or veterinarians can also provide valuable insights. Ultimately, the decision to get dog insurance is a proactive step towards ensuring that your pet receives the best possible care throughout their life. It reflects a commitment to their health and happiness, allowing you to cherish every moment with them without the constant worry of unexpected medical expenses looming over you. As a responsible pet owner, investing in dog insurance is akin to investing in peace of mind and the longevity of your cherished companion. Frequently Asked Questions

https://www.petinsurancequotes.com/

Find the best pet insurance for dogs and cats. Compare coverage, cost, wellness plans, and more from top insurers. Get a free quote for your pet today. https://www.petinsurance.com/dog-insurance/

How does dog insurance work? - visit-any-vet-icon. Visit any specialist. At the first sign of health issues, bring your dog to any licensed veterinarian anywhere ... https://www.geico.com/pet-insurance/

Pet insurance is a specialized health insurance for your beloved pets. Get affordable care for your pets by contacting GEICO today. Pet health insurance ...

|